DeFi and the future: a tale of cautious optimism

Happy Holidays everybody, as the year comes to a close and you drink away your problems from the past year and pretend next year you will be better; take a seat and read this edition.

Happy Holidays everybody, as the year comes to a close and you drink away your problems from the past year and pretend next year you will be better; take a seat and read this edition. This issue features a piece written by ArbiAlpha, a Financial Economics graduate, who became well-versed in Blockchain and DeFi technology after gaining interest for the space in early 2020. As well, I am back again with a breakdown of why ETH Jesus is excited this holiday season. So put down the rum & eggnog (it’s your fifth Christmas party…you’ll be okay), and sit back and read. Enjoy.

What excites the ETH Lord and Savior, Vitalik, about the ETH ecosystem?

With the cruel winds of winter blowing through our great white nation (sorry international readers, bare with me here) and the DeFi landscape, we were in need of some warmth. Well, luckily, the messianic (my roommate helped me spell this word) figurehead of ETH, Vitalik, decided to give some heat to the landscape by outlining what in the Ethereum application ecosystem excites him. The document itself is half instructional packet, half manifesto, and a dash of analysis…and makes for an incredible read. Now, because I love you all so much (not really), I have broke it down for you to hear in bite-sized parts:

The Monetary

If you are a wealthy nation…

Safety against de-platforming

Easy way to make donations

Private money in a cashless society

How about Stablecoins?

3 types of stablecoins include:

Centralized

DAO-governed/traditional asset-backed

Digital asset-backed

Open use by anybody

Censorship-resistant (for the most part)

They interact well with on-chain infrastructure(s)

Stablecoins (each type) come with advantages and trade-offs

DeFi (yay, our favorite word)

DeFi products came in many different shapes and sizes (with the DeFi stablecoins being arguably the most important)

Other important uses include: prediction markets, major stock indices and real estate, efficient trading layers for inter-asset transactions

Who are you? Let’s talk identity

Privacy and scalability remain difficult to combine as a single solution

Privacy can be achieved by putting together on-chain and off-chain info + using ZK-SNARKs

DAOs (decentralized autonomous organizations)

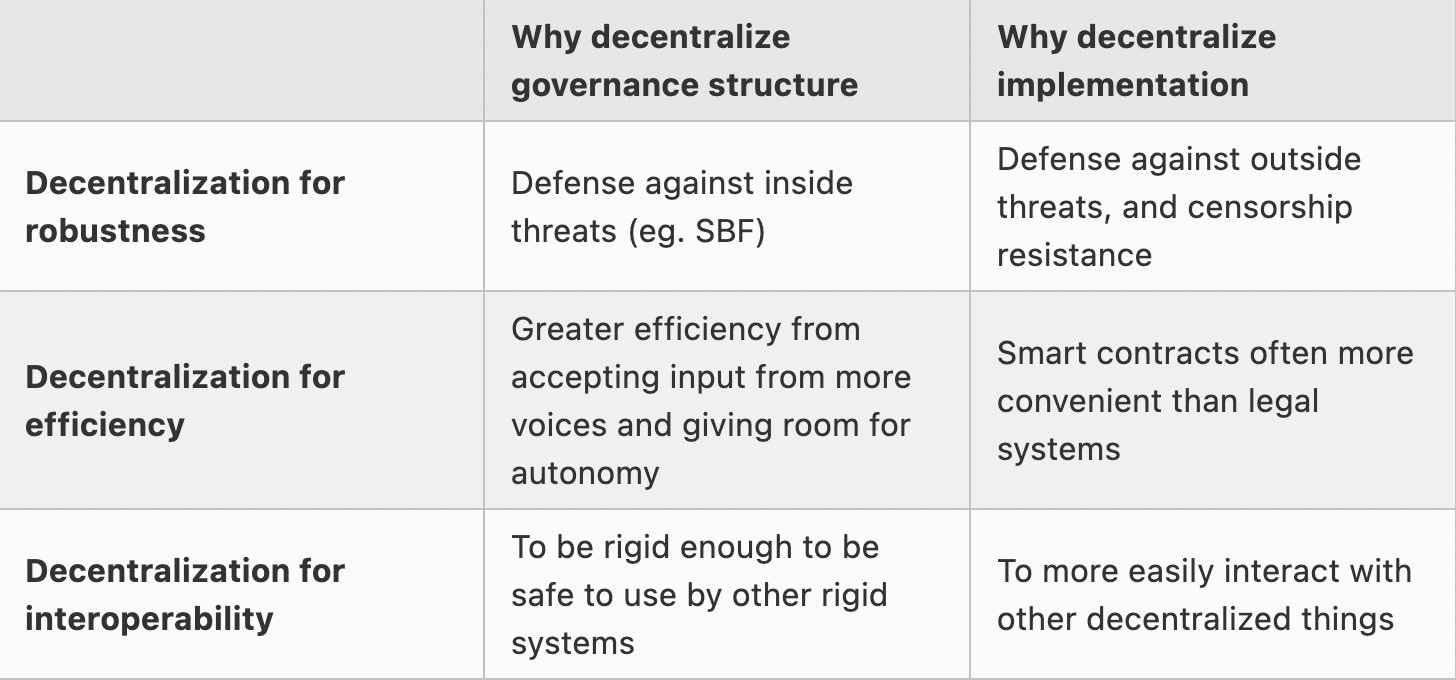

Above are the common governance structures and why they are used

The efficiency model is not good for large-scale activity but can be advantageous in highly internationalized projects and countries with weak rule of law and rampant corruption

Improvements to the robust model could include decision-makers being token holders and some other user class, as well as, implementing intentional friction delaying decision implementation

Hybrids (no, not that car your mom won’t stop talking about)

Hybrid applications that utilize blockchain and traditional systems can be used to increase trust in our institutions (voting, government registries, corporate accounting, etc.)

Unfortunately, blockchains tend not to be scalable and transactions take time to get on-chain

Wallets can be complicated to use for the mass public and are not all safe

Theoretically, rollup solutions can help solve scalability and ERC-4437/account abstraction wallets can increase wallet use and safety

I know there are a lot of terms and words that you’ve heard the comp-sci kids say at a party once, but the point here is clear. The next generation, the future if you will, of the ETH system is seemingly looking bright according to the resident ETH clairvoyant himself. The idea here seems to be that even though the ecosystem has its weaknesses and vulnerabilities, there are possible solutions and a willingness to implement them meaningfully with the user in mind.

GMX - The Next Generation of Decentralized Exchanges

Written by @ArbiAlpha

While the bear market has been wreaking havoc at Chainlink Labs, a blockchain development company has been working hard to solve the problem of scalability on the Ethereum network. They’ve done this by creating Arbitrum - a Layer 2 network built on top of Ethereum, that has the security of Ethereum but enables lightning-fast settlements, for a fraction of the transaction fee, which is essentially what everyone wants.

Arbitrum, with its low transaction fees, is a massive win for DeFi protocols (think of New York Giants v. New England Patriots in the 2007 Super Bowl level win). If you know anything about the space then you know about how high Ethereum's transaction fees are, meaning it wasn’t a sustainable home for DeFi protocols due to the volume required with the use of DeFi.

There have been many great projects to come out of the Arbitrum system during this bear market, but there is one in particular that has spread its wings and is worth talking about, GMX.

GMX is an Arbitrum native decentralized exchange that was born on the real-yield narrative that has gained significant traction recently since the FTX debacle.

GMX generates its holders, and liquidity providers' income by distributing the fees generated from trading fees, swaps, and market making. That is why we call it “real-yield”, it’s actually generating real revenue that is then returned to its holders in full. In the previous DeFi boom, protocols would rise and fall because they were paying their holders out with token emissions as they were failing to generate revenue. This structure of paying holders with emissions resulted in inflated tokens that got destroyed when the bear market came around.

With DeFi being as young as it is, it’s no surprise there are significant risks using the platform; smart-contract failure, hackers, and regulation - just to name a few. GMX doesn’t seem to care, and they have been producing an attractive real yield for their stakeholders. Last week they generated $3,300,000 in fees that got distributed to their holders. Resulting in a 15.5% yield for the governance holders (Receive 30% of fees generated) and 30.75% to its liquidity providers (receive 70% of fees generated).

Thank you for reading today's section on GMX, if you’d like to learn more about GMX and its potential in the DeFi and Arbitrum space check out this thread, and consider following https://twitter.com/ArbiAlpha for more content around DeFi and the general crypto space.

Last word

Again, I would like to thank ArbiAlpha for writing this issue. As we start to round out the year, it is worth remembering that the DeFi space is not all doom and gloom despite the calamities of recent memory. There are still worthwhile projects and people building useful things out there. Hopefully, we see more vigor in that spirit in 2023. Happy Holidays, and as always, if you liked what you read, please subscribe.