New year, new market(s)?

Happy New Year my fellow nerds and curious minds. I have been away for a while, traversing through the avalanche of stories (and you know, recovering from the lethargy that is the holidays).

Happy New Year my fellow nerds and curious minds. I have been away for a while, traversing through the avalanche of stories (and you know, recovering from the lethargy that is the holidays) to find you the perfect ones to start the year. This issue I offer you a healthy mix of the same old chaos of the De/CeFi world along with some innovation. I believe in a mix of good and bad. 2023 is about balance, friends…now balance that mouse over the share button (I know, but I think it was clever), click, and then get to reading!

DOJ goes James Bond and snags a (small) villain

Recently (January 18th, 2023) the diligent enforcement vanguards (I say with dripping sarcasm) announced a massive international enforcement action of a particular digital asset company. This announcement came via the trusted, if not a bit obnoxious, method of a press conference which featured a who’s who of the middle management version of federal and financial law enforcement.

The company in question, Bitzlato Ltd., was charged with money laundering and had its founder arrested in balmy Miami, where all the most trustworthy finance professionals work (was that sarcasm, can you guess). The company based in Hong Kong was considered “an international pariah” and “a busy corner in this criminal ecosystem” by French authorities, the FBI, and the U.S. Treasury Department. The founder, Legkodymov is a Russian born Chinese resident…that is until his arraignment which was scheduled for Wednesday in the U.S. District Court for the Southern District of Florida.

The exchange (a generous word for what they were doing) offered P2P services and hosted wallets. Now, these wallet holders happened to be criminals buying and selling illegal goods to the tune of $700M in the last several years. Authorities seem to be most upset about the exchange facilitating transactions for Russian ransomware actors (including those connected to the state)...which all sounds like a terrible script to a new James Bond movie.

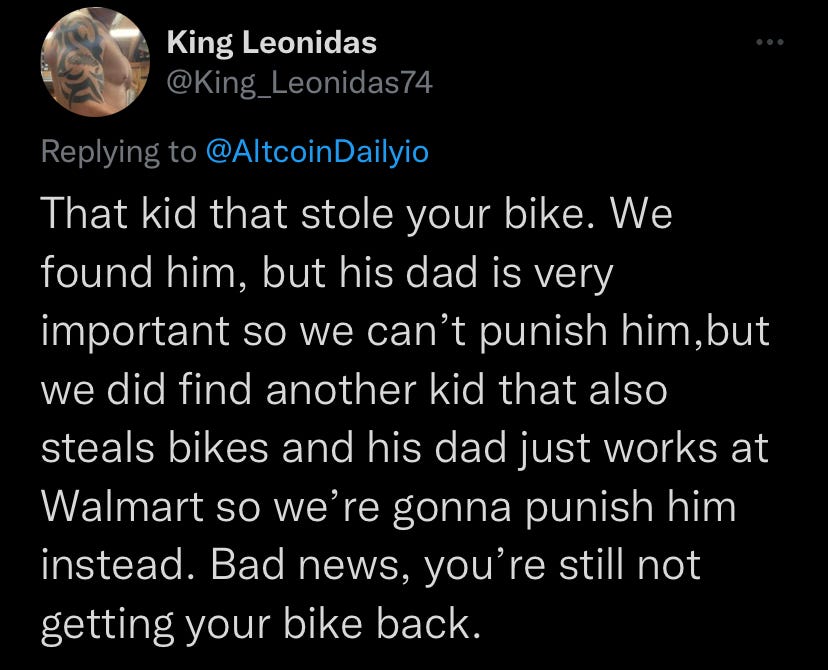

Now, some people in the DeFi world are unhappy that the DOJ seems to be picking and choosing what to enforce and when. The grievance can be summed up in the below tweet:

Uh-oh…another bankruptcy looming?

Well friends, surprise surprise, another digital asset firm seems to be careening headlong to bankruptcy. Genesis Global Capital, according to sources close to the company, is laying the groundwork to file. They have reportedly been in discussions with various creditors because of serious liquidity shortfalls and must raise cash.

Genesis started to feel the heat when the hedge fund 3AC collapsed (I talked about that). Now, like a comically unlucky protagonist in a slapstick comedy, FTX soon after filed for bankruptcy (also spoke on this) which then forced Genesis to halt withdrawals (Genesis held some of its funds on FTX). On the back of these black swan events several business units at Genesis began to unravel and collapse.

The company now seems to be working at a restructuring plan while swapping proposals with creditors. The parent company has suspended quarterly dividend payments in an effort to preserve cash (yikes).

The problem with Ethereum…

By Chase Kazakoff

Ethereum, like all blockchain networks, is a decentralized system that is reliant on a network of computers to process and validate transactions. This has led to scalability issues, as the network can become congested and slow down as more users and transactions are added.

In comes Arbitrum, the solution to this problem.

So what is Abritum?

The Arbitrum network, developed by Offchain Labs, aims to alleviate the congestion on the Ethereum network by utilizing a layer-2 solution for validating smart contracts. By running smart contracts on a separate layer, it reduces the load on the main Ethereum network, allowing for faster and more efficient processing.

This is achieved through a process called "transaction rollups," where batches of transactions and records are validated on the lower layer before being moved to the main Ethereum network. The network incentivizes validators, known as aggregators, with ETH for their role in adding blocks to the Ethereum mainnet.

Arbitrum has been gaining attention as a promising solution for scaling the Ethereum network. Unlike some other blockchain projects, it has seen strong user growth and its approach aligns with the goal of building solid infrastructure for public blockchain rather than focusing on the market value of a native token.

As it does not have a native token, investing in Arbitrum may not be possible through traditional cryptocurrency channels. However, one can gain exposure to Arbitrum by investing in applications built on its infrastructure or through purchasing Ethereum. In the current market conditions, the latter may be a safer option.

Final Word

Well, as always, thank you for reading. As this new year keeps charging on with an alarming rate of speed (guys, it’s almost February), the digital asset world will be interesting to watch. I am sure there is more drama, collapses, money to be made and lost, and so many more stories. So, subscribe and keep yourself in the know (it’s only wise).