The Contagion Effect: Digital asset problems spreading far and wide

Happy World Cup week readers, as the world turns its eyes to the small Middle Eastern nation of Qatar, our eyes (and wallets) will be fixed on the continued meltdown of the digital assets sphere

Happy World Cup week readers, as the world turns its eyes to the small Middle Eastern nation of Qatar, our eyes (and wallets) will be firmly fixed on the continued meltdown of the digital assets sphere. This issue will not only feature my musings and half-unhinged ramblings, but will also include guest writer, Buk Nkosi of Chaos Club Digital and Holdr, in a delightful piece you’ll get to read. With that being said, let us dive into a sordid world that, shockingly still, is devoid of any responsibility or common sense…and rife with something bordering blatant criminality.

Sam Bankman-Fried (SBF), the puppet master of chaos

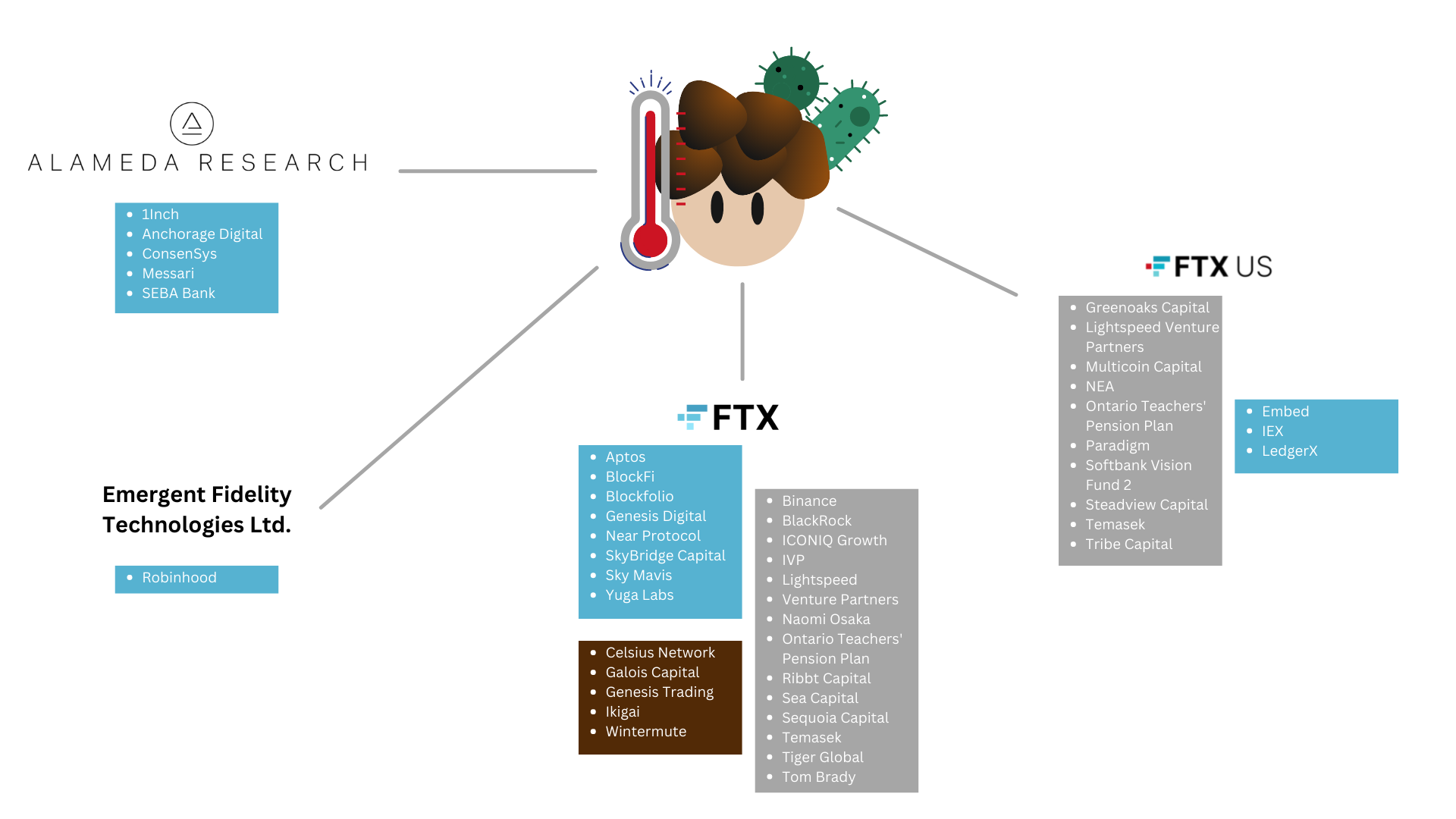

In case you somehow missed it, you should be somewhat aware of the FTX meltdown that occurred due to gross mismanagement by SBF of his business entities. With each passing day, however, a new detail gets added to the already incredible story. As such, I have decided to map out the path of contagion that SBF has and what entities have been touched by his toxic touch. Welcome…to the Bankman-Fried-Verse:

As you can see, the bonafide money black hole himself, has had his grubby little fingers on almost every aspect of the financial industry and your boyfriend’s favorite athletes. It would be impressive if it didn’t amount to a staggering loss of wealth.

FTX resembling Qatari soccer team; complete lack of control and structure

Let’s keep this “FTX and SBF suck” party going kiddos (it’s BYOB by the way, Bring Your Own Bankruptcy). If you, like myself, do not have a life and spend time traversing through Twitter feeds and bankruptcy filings, you will have seen FTX’s extraordinary filings. The nature of which outlined just how mismanaged this entity was. Let’s dive in:

The amazing thing here is that a multi-billion dollar company was run like your business school friends group project. No responsibility, nobody on the same page, with a dash of morally reprehensible behaviour. In short, the gravity of the situation is best conveyed by the below excerpt from the restructuring CEO, John J. Ray III, in the Chapter 11 Bankruptcy filing:

Crypto & Blockchain: Not the same, and it’s time we talk about it

Written by Buk NKOSI

The terms blockchain and cryptocurrency are often used interchangeably despite not being the same thing. Cryptocurrencies are digital currencies, of which Bitcoin and Ether are the most ubiquitous examples. They work on a blockchain - a distributed database that only allows data to be added according to strict rules. The problem with not differentiating between the terms is that people who distrust digital currencies may be dismissive of the potential of blockchain technology. After the recent revelations about FTX, which was previously the second biggest crypto exchange, public perception of the entire web3 space has been besmirched.

The FTX saga and the many other scandals that have plagued digital asset adoption have led numerous people to become critical and pessimistic. Digital currencies, on average, have seen a massive decline in value. So far this year, as interest rates have gone up and financial markets have become unsteady, investors have stopped investing in riskier assets like these currencies. Bitcoin specifically has dropped -62% since last year's growth.

So while it is evident that most prominent digital currencies have declined in value, the best is yet to come in unlocking blockchain's value. Blockchain is one of the most exciting new technologies in the world today, with the potential to transform nearly every industry. This technology can shift how we think about data and security, allowing for greater decentralization and increased transparency across various aspects of society. Ultimately, the utility of blockchain can be unlocked independently of the fluctuation of the value of digital currencies.

By decentralizing information and eliminating intermediaries, blockchain adoption could improve established business models, many of which are outdated. With its ability to streamline processes, reduce costs, and authenticate ownership, blockchain has become one of the most promising tools for driving innovation and success in today's fast-moving digital economy.

The key to unlocking blockchain's value will be the pursuit of utility that makes existing activities more efficient or secure. Historically, the focus has been on the sensationalized idea that blockchain and web3 will change everything soon and fast, which has led to ridicule from many observers unfamiliar with the web3 space. Technology with actual value is never built fast or adopted overnight.

Last word

Firstly…I want to thank Buk Nkosi for writing a piece for DeFi Tomorrow, and one rife with incredible insight and information. Buk is a smart man who is always on the forefront of art and innovation over at Chaos Club, Holdr, and everywhere else he applies his Midas-like touch.

Finally, as you can see, times are turbulent in the digital asset world, and it seems that all the empires built upon sand are being washed away. This space only promises to be more chaotic, interesting, and every adjective in between. As always, to stay up to date and read my lame jokes, aggressively smash that subscribe button.